Why Intelligent Automation is the Key to Cutting Your SG&A

Times are still tough for companies of all sizes and CFOs are continuing to try and work out how they can do more with less as they face more pressure than ever to combat the stubborn inflationary pressures and reduce Operational Expenses (OpEx), while simultaneously helping add strategic value and driving growth across the business.

A McKinsey report found that 70% of CFOs and other finance executives felt ‘unprepared’ or worse when asked about confidence in meeting spend reduction targets. And these cost-reduction targets continue to become more aggressive – respondents said they were aiming for an average cost-reduction target of about 16 percent for SG&A over the next year, representing a 45 percent increase over McKinsey’s previous survey.

How to Drive Growth and Do More with LessSo the question for CFOs is how can they achieve this holy grail of driving growth, while aggressively cutting costs and doing more with less? Recent research from Hackett identified that the key action of successful finance leaders was to cut costs only in areas where the work can be replaced by more efficient technology, such as innovative, autonomous solutions.

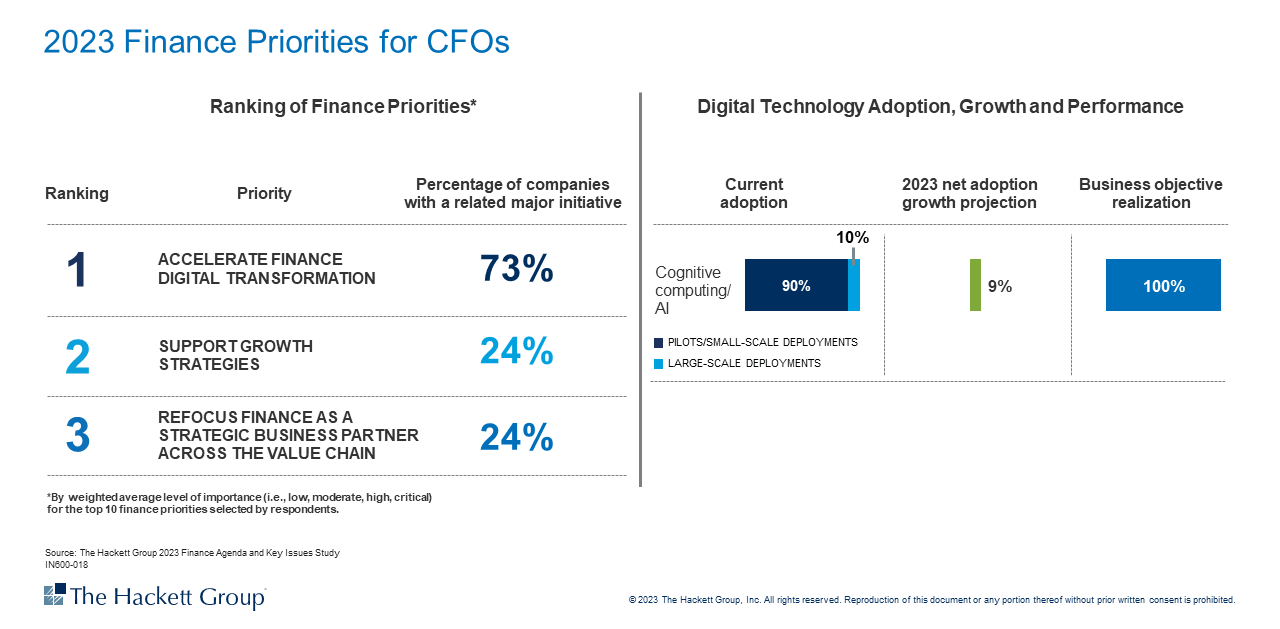

Supporting this imperative, Hackett’s CFO Report 2023 states that digital transformation has now become finance’s top priority and CFOs must be prepared to invest in new digital solutions to reduce cost and create new capabilities through aggressive adoption of AI and other game-changing technologies. And CFOs agree – 73% made digital transformation of the finance function their No.1 priority for 2023 (the next highest priority was optimizing working capital on 32%).

100% Satisfaction From AI Applications in the Finance Function

However, for finance to succeed and add greater value and impact across the business, digital technologies need to be rolled out at enterprise scale and, according to Hackett’s findings, this is not happening currently.

Less than 10% have invested in Cognitive computing/artificial intelligence (AI) solutions but, and this is the biggest takeaway from the report, where they are utilized, AI-driven solutions are, without exception, delivering business value and ROI. Of the companies Hackett surveyed, 100% reported that AI deployment had met or exceeded business objectives.

So the goal is clear for CFOs across all sectors and industries – become the intelligent, autonomous enterprise of the future by adopting AI-powered technology in order to gain competitive advantage through cost savings, reduced expenses and adding strategic value across the business.

- 73% of CFOs want to prioritize digital transformation of the finance function

- 100% of programs adopting the power of AI met or exceeded expectations – finance organizations have significant opportunities to expand these beyond pilot projects or small-scale deployments

How does embracing this smart automation improve your buying model and enable you to better manage your company spend? Autonomous procurement and sourcing technology allows companies to quickly and easily define their needs, compete those needs among both approved suppliers and pre-vetted challengers, then negotiate digitally before ultimately making the best decision based on insights, transparency and compelling alternatives.

It eliminates the repetitive, manual work that takes up procurement’s time, while the consumer-grade user experience means business stakeholders no longer work around procurement (a process known as unmanaged spend) with the subsequent lack of supplier competition leaving substantial cost savings on the table.

By democratizing how an organization buys everything it needs – putting the purchasing decisions in the hands of the experts who own the budgets and allowing them to work however they want – this new model also ensures issues such as risk management and ESG targets are adhered to while instantly improving your bottom line.

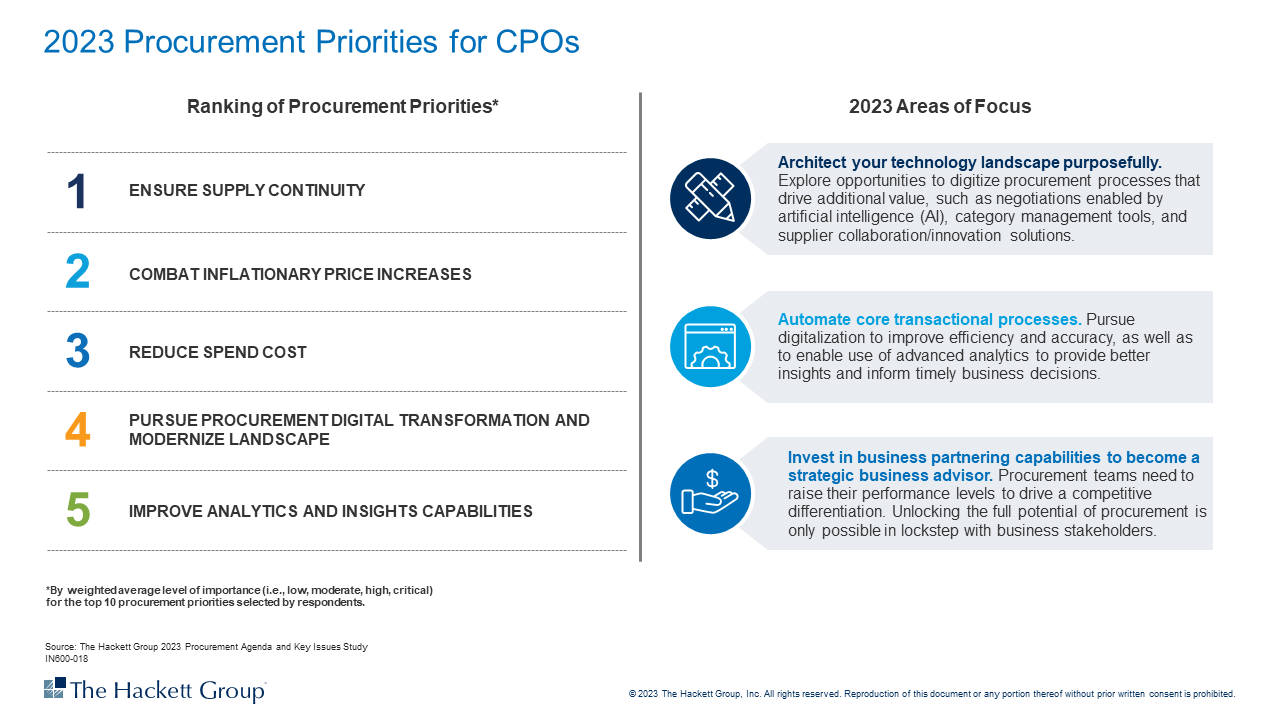

If finance partners with a company’s CPO to embrace this game-changing new procurement technology, together they will reap the rewards and drive cost savings and new efficiencies from day one – as the Hackett 2023 CPO Report states, these are the top priority for procurement, as well as finance, and solving this challenge provides a great opportunity for the two functions to work together.

- CPOs top priorities – Combat inflationary price increases & reduce spend cost

- Hackett’s key focus areas for CPOs: 1. Architect your tech landscape to utilise innovation and AI 2. automate core transactional processes 3. Invest in business partnering capabilities

BT Group and Tesco Lead the Way

Some leading companies have been early adopters in this field, identifying innovative technology as the way to reduce their SG&A, while freeing up procurement to focus on higher-value tasks and initiatives. BT Group, the UK-based telecom provider, has enjoyed double-digit cost savings on nearly £6bn worth of spend matched through the platform, while leading grocery retailer Tesco has placed record sums of spend through autonomous sourcing in less than six months to increase sourcing efficiencies and deliver greater value to its customers, communities and shareholders.

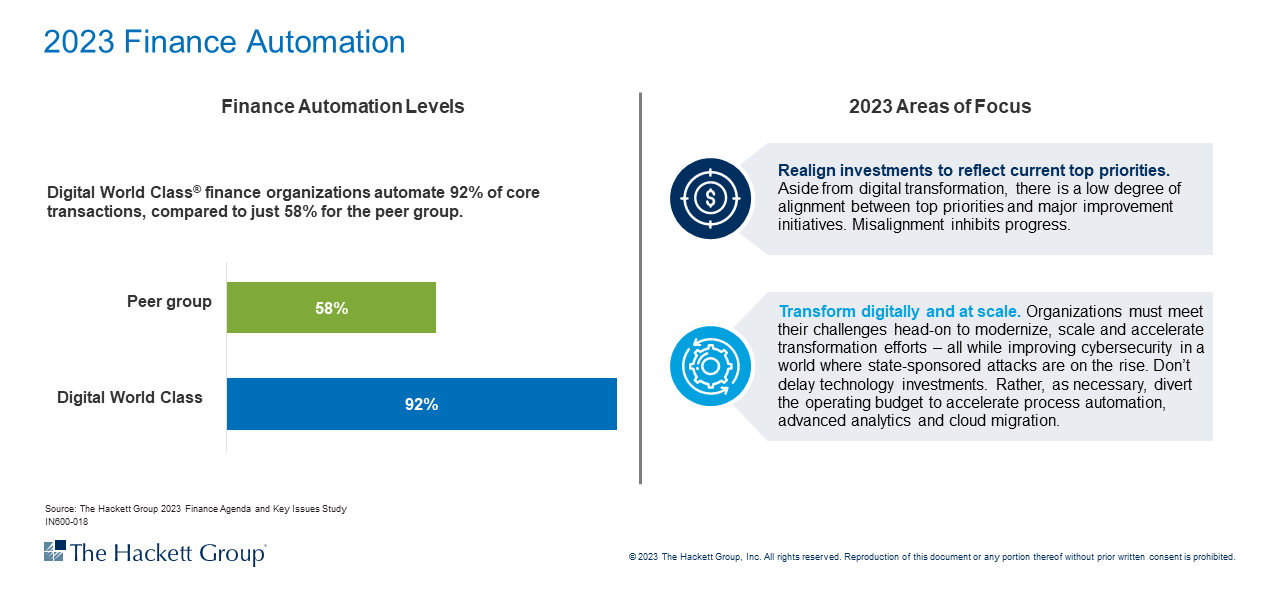

The Hackett CFO report highlights that high-performing companies automate more than 90% of their routine transactions, as opposed to just over half at their peers. And Hackett’s key focus areas for CFOs this year are to put their investment budget into key priorities – digitalisation– and then drive through this transformation at scale and with urgency.

- Digital World Class finance organizations automate 92% of core transactions, compared to just 58% for peers

- Key focus areas for CFOs: 1. Realign investments to reflect top priorities. 2: Transform digitally at scale

With the weight of evidence on the need to optimise a company’s SG&A spend, there is no reason for CFOs to adopt a wait-and-see approach. Those who follow the lead of the Fortune 500 businesses referenced above will be best-positioned to gain competitive advantage as they navigate the current economic uncertainty and drive future growth and opportunities.

Globality can help you can cut your SG&A instantly. Talk to us and let’s calculate how much bottom line savings autonomous sourcing can deliver.