Why Private Equity Firms Should Mandate Autonomous Sourcing to Cut Costs Instantly

Over the years, PE firms have mastered the art of creating value for their portfolio companies through aggressive cost reduction, increasing operating efficiencies and reducing headcount where necessary through outsourcing of back-office functions, the streamlining of processes and optimizing supply chains. But after years of rationalization, many firms have started to exhaust this low-hanging fruit along with the option of merely cutting budgets as the typical cost-saving options. The reality is that costs are going up and will continue to go up—inflation is a rising tide which figuratively raises all boats—starting with unit prices and finding further savings in the future will be a much harder task for even the most focused of firms.

Furthermore, cutting departmental budgets within portfolio companies is now only having the effect of making it harder for leaders within those businesses (CMOs, CTOs, CHROs etc) to deliver the impacts they are charged with. The only way of reducing overhead is to look at other parts of the enterprise which can produce savings if better managed. As EY recently revealed, the pressure on PE Firms is arguably even greater, as they also face falling price multiples and higher financing costs, propelling a need to maintain EBITDA levels and adding greater urgency for further cost improvements.

FOCUS ON INDIRECT SPEND TO REDUCE OPEX

But the good news is there is one area, ripe for immediate cost savings, that is often overlooked by finance chiefs of enterprise companies—better managing a company’s indirect spend. The amount of indirect spend is typically around 20% to 40% of revenue, and is usually classified as Selling, General and Administrative expenses (SG&A). As this report from Alvarez and Marsal highlights, there are big savings opportunities for mid-sized companies from their indirect spend—uplifting EBITDA by between 0.4 and 2.0 percentage points, which equates to circa US$20-25 million in savings for a US$1 billion revenue company.

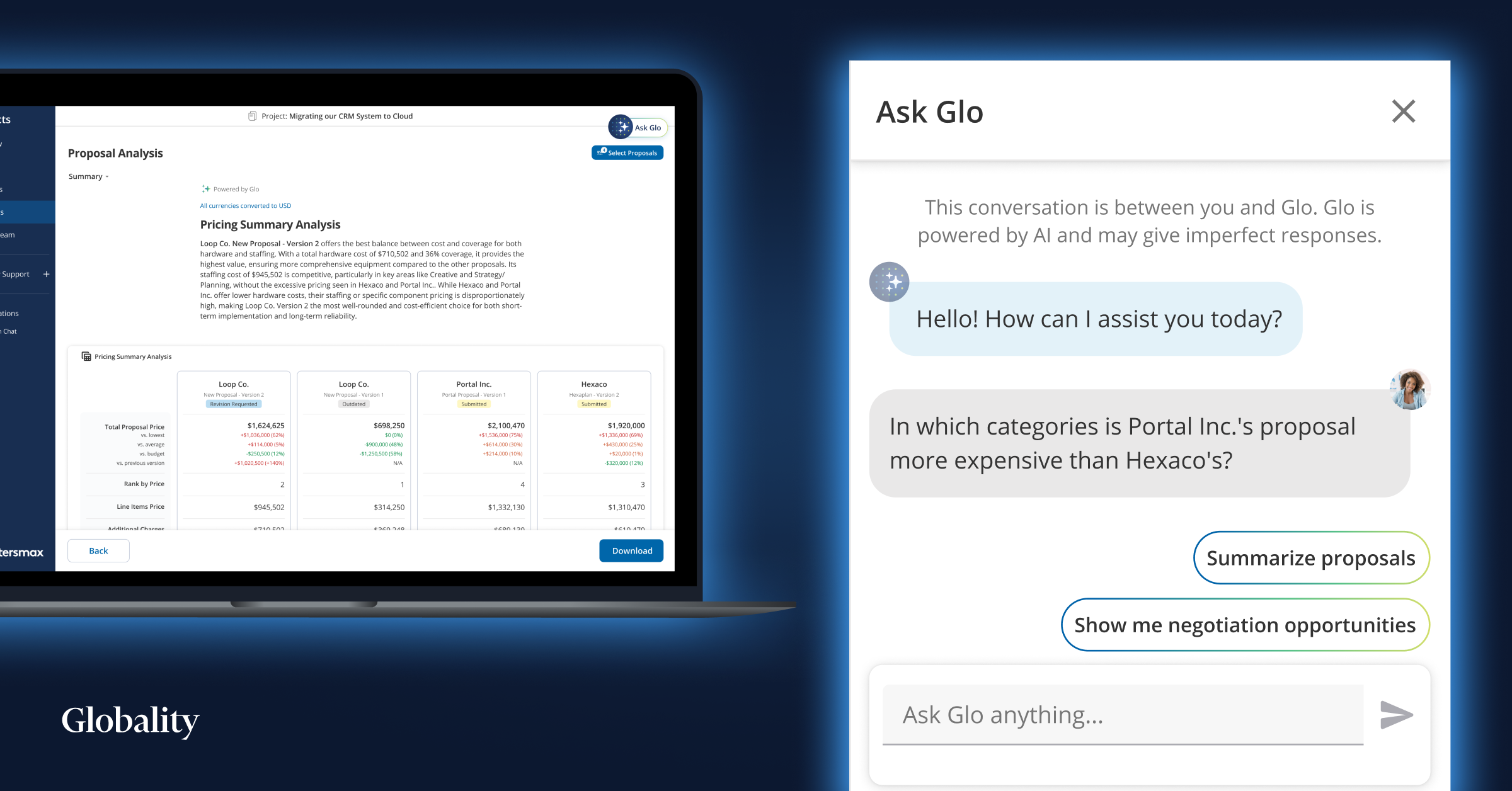

Autonomous sourcing allows you to manage this spend more efficiently, delivering instant savings through the automation of the previously manual process of running Requests for Proposals (RFPs) via spreadsheets and emails. This transformation enables leaner teams to do more with less, while reducing speed-to-market from weeks to days and increasing supplier competition to drive down the prices you pay for all your indirect services from day one.

SELF-SERVE SOURCING TO HELP DRIVE GROWTH

With autonomous sourcing, business stakeholders can self-serve through an AI-powered platform rather than labor-intensive procurement teams managing the process for them. Instead, smaller procurement teams oversee the process, ensuring guardrails and compliance are in place, while focusing their time on more productive, strategic tasks that add wider business value and drive growth across the enterprise.

So with nothing left to squeeze out of supply chain costs or departmental budgets, and the workforce already trimmed back as far as it can go, private equity owners should prioritize indirect spend within their portfolio as the area where they can optimize costs quickly and effectively. One reason that most c-suites aren’t already doing this is that it’s traditionally been very hard to get real transparency into that ambiguous “20 to 40%” bucket. However, times are changing. With the help of data at scale and especially the application of machine learning, new and better ways of sourcing even the most bespoke indirect spend is available and deployable now.

By adopting new technology to ensure that all third-party spend is tendered fairly, competitively, and transparently, companies are instantly able to get more visibility, control and assurance of buying the right goods and services at fair market prices across all of their expenditures. Legacy procurement processes and technology mean that many employees simply bypass the designated systems and engage in unmanaged spend as they need to be able to execute their jobs in the marketing, R&D, technology, human resources, real-estate and other functions in the company with a reasonable degree of speed and simplicity.

Globality's 2023 research for CFOs found 82% of procurement leaders say their indirect spend is not well managed during the sourcing process, leaving substantial cost savings on the table. But forward-thinking companies have identified autonomous sourcing as the answer to this conundrum—the user-friendly, consumer-like experience means using this technology for all company spend above a certain threshold is one mandate that their workforce is happy to embrace.

DOUBLE-DIGIT SAVINGS FOR GLOBAL ENTERPRISES

Leading global companies like BT and Santander have partnered with Globality and leveraging advanced AI technology to avoid overbuying and saving 10-20% on their billions of dollars of indirect spend across categories including marketing, IT and hardware, legal, HR, property management and construction. As they have already discovered, when the transformative power of Generative AI meets autonomous sourcing, the use case is compelling and it accelerates automation further and faster to cut costs and deliver ROI even more quickly.

And there’s other good strategic reasons for PE firms to mandate the adoption of this new technology across their portfolios. Digital transformation is seen as an increasingly important value creation lever that can help portfolio companies increase cash flows and profitability. A recent survey from KPMG revealed that investing in game-changing digital solutions such as autonomous sourcing will double in importance over the next three years for private equity firms.

ADDING VALUE TO YOUR PORTFOLIO COMPANIES

Successfully implementing a buying mandate across a PE firm’s portfolio means substantially more spend at each company will be managed by technology with streamlined processes and more competition through a transparent, inclusive sourcing process that immediately drives costs 10-20% lower and increases efficiencies by up to 70%. Thanks to the intuitive, user-friendly experience, PE firms who invest in autonomous sourcing solutions will find that mandating their use is far easier than has often been the case in the past and that their portfolio businesses will not only realize value from day one but also be better positioned to improve the bottom line in the long term.

Check out how our Generative AI-powered bot, Glo, delivers 70% efficiency gains, 10-20% cost savings and 20X ROI.