The Magnificent Seven: A Guide to Tomorrow’s CFO Tech Stack

The office of the CFO has traditionally had six functions, or areas of business, that together form the work and tasks of the finance team. Each area has built up an accompanying technology stack with increasing levels of automation being injected into processes as finance leaders strive for new efficiencies and cost reductions while increasing governance and control to improve risk management.

Across each function, new software from innovative vendors has become popular with CFOs as they’ve seized on the imperative to automate repetitive, low-value tasks and free up their teams to focus on more strategic work that creates opportunities for enterprise investment and growth.

- Procure to Pay systems such as SAP, Coupa and GEP have established themselves as an integral part of the CFO office, automating the purchasing lifecycle – from requisitions and POs to receiving goods and payment.

- Order to Cash has seen the advent of autonomous receivables through technology pioneered by the likes of Sage, Oracle and Esker.

- Treasury has automated both cash forecasting and cash management with software such as Kyriba.

- Record to Report has successfully implemented autonomous accounting with tools like High Radius and BlackLine.

- FP&A uses planning tools like Anaplan to transform a company’s financial decision-making with connected planning and insights.

- Tax software such as Vertex automates and digitizes processes from exemption certificate management to B2B validation to invoicing.

But what many CFOs don’t realize is that there is now, in fact, a seventh area of business within their office and that this function offers the biggest and quickest opportunity to deliver improved productivity and increased efficiencies through the use of AI-driven automation – the chance to pick the lowest-hanging fruit and demonstrate immediate ROI on investment in new technology.

Spend management refers to every dollar a company pays out for goods and services but is often overlooked and hidden away in a dark corner of procurement. Effective spend management helps to ensure that every expenditure is necessary, strategic, and provides value to the company. It also involves analyzing spending patterns, identifying inefficiencies, and making adjustments to improve financial performance.

If a CFO brings more of their company’s spend under management, instead of allowing the business to bypass procurement with ‘rogue’ or ‘maverick’ spend then not only will they see 10-20% cost savings due to increased supplier competition, but cycle times will reduce by up to 90% as slow manual processes are automated.

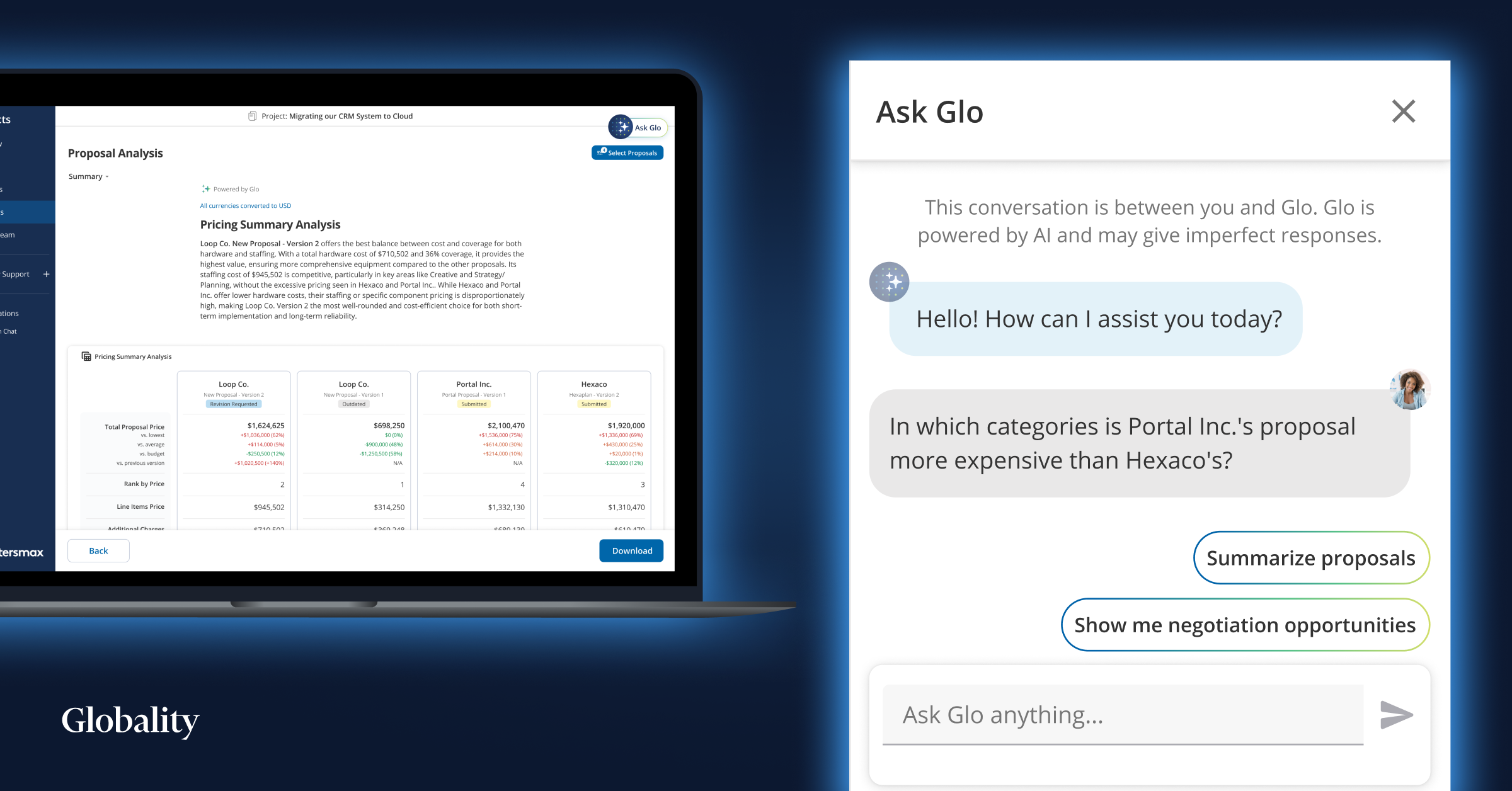

Using automated spend management technology such as Globality, global enterprise companies can reduce the RFX process from 3-6 months to 27-35 days on average. This dramatic increase in speed and efficiency comes at all stages of the purchasing journey.

With AI-driven autonomous sourcing, the business user can still lead the process and include their preferred suppliers. However, within rules and guardrails set in place by procurement that will enhance competition and improve compliance and risk management by ensuring all purchases adhere to company policies.

Reducing the sourcing cycle from 3-6 months to 27-35 days

Engagement Initiation (Was 1 week, Now 1 day)

- Business User (BU) raises requestion for RFx

- Schedule kick off call with BU (to discuss process)

Supplier Information & Requirement Gathering (Was 2-6 weeks, Now 2-3 days)

- Buyer sends NDA to new suppliers

- Buyer/BU partner get RFX documents together

- Buyer/BU agree timeline

RFx quotation phase (Was 2-4 weeks, Now 8-10 days)

- Buyer issues RFx email to selected suppliers which will include timeline & related documents

Quote Evaluation (Was 2-4 weeks, Now 2-3 days)

- Buyer receives quotes back

- BU/Buyer evaluate quote

Presentation (Was 2-4 weeks, Now 5-8 days)

- Shortlist selected supplier to present to BU

- Buyer starts negotiation conversations before and after presentation

- Buyer/BU select supplier

Contracting Stage (Was 1-6 months, Now 3-5 days)

- Contracting process begins

RFx Close Out (Was 1-2 weeks, Now 1-2 days)

- Buyer informs unselected suppliers

In many cases, G2000 companies are enjoying even greater efficiencies than those listed above. Iconic UK-based telecoms provider BT reduced its cycle time to market from seven to ten days down to just one day and reported this substantial efficiency gain in its 2024 Annual Report.

These figures were based on more than 1000 projects sourced on Globality’s AI-driven platform across nearly £8bn of spend so represent substantial new value to the business.

“We are now using generative AI so that our teams just have to type one sentence and the generative AI will help them along to do everything all the way to engaging with suppliers. It has super simplified the whole process,” says Cyril Pourrat, BT’s Chief Procurement Officer.

In addition to those speed to market improvements, BT has enjoyed double-digit savings across that spend as users collaborated with colleagues and suppliers and significantly reduce costs through increased competition, data-driven insights, and intelligent analysis.

Similarly, one of the world’s most recognizable sporting goods brands has adopted autonomous sourcing and its business users now self-serve for all events up to $3m with no involvement from procurement whatsoever. That has freed up 30 people from its Business Process Outsourcing office to work on other, higher-value projects – huge value to the company.

In an era where every dollar counts, especially in the face of economic uncertainties, managing spend more effectively can unlock significant value for a company, directly impacting its bottom line and bridging the gap between finance, procurement, and overall corporate strategy.

Adding spend management as the seventh function of the CFO office is not just a necessity; it’s an opportunity for CFOs to drive greater value for their organizations. The scope of their responsibilities has expanded beyond traditional financial management and CFOs are now strategic partners in business decision-making, playing a crucial role in driving growth and innovation.

Click here to book a demo of our award-winning AI-driven spend management platform.